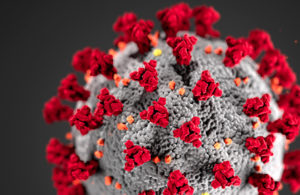

As the COVID-19 pandemic continues to ravage the world, the medical device industry is scrambling to meet the demand for devices that have experienced shortages. Ventilators are among them, and tubing and extrusion companies say they are doing their best to support device makers during the pandemic.

As the COVID-19 pandemic continues to ravage the world, the medical device industry is scrambling to meet the demand for devices that have experienced shortages. Ventilators are among them, and tubing and extrusion companies say they are doing their best to support device makers during the pandemic.

Since the start of the pandemic, tubing manufacturers have seen a spike in orders, and industry-watchers have noticed.

Analysts recently estimated that the coronavirus pandemic would grow the medical tubing market by over 13% by next year. Markets and Markets projected that silicone tubing would lead that growth because of its use in drug delivery applications such as infusion pumps. Prior to the pandemic, analysts estimated that the medical tubing market would grow at a revenue-based consumer annual growth rate of 9.2% over the next five years.

Freudenberg Medical’s operation in Germany has seen a sharp increase in silicone tubing requirements for ventilators and oxygenators, Rudi Gall, general manager of Freudenberg Medical Europe, told Medical Tubing + Extrusion. The company’s silicone operation in California reported a similar increase in extruded tubing orders for pharmaceutical and medical device customers.

“Demand for silicone raw material exceeded the supply side in 2019 which had a negative impact on price and availability,” Gall said. “This has somewhat changed in recent months and we are seeing the market trending to a more equal demand and supply-side pattern.”

Ventilators are essential to combating the coronavirus but are in short supply around the world. The device helps patients breathe and takes over the breathing process when the SARS-CoV-2 virus causes the lungs to fail.

The anatomy of an invasive ventilator is standard. A ventilator unit controls air pressure and sends air through a tube to a humidifier that matches the air to the patient’s body temperature and adds moisture. The tube is inserted into a patient’s airway and into the lungs to give them oxygen, according to Hamilton Medical.

Medtech trade group AdvaMed on April 1 said that respiratory device companies that belong to its organization have boosted ventilator production to 2,000–3,000 per week — and expect to soon reach 5,000–7,000 ventilators per week. Those same companies were making 700 per week domestically last year.

Tubing companies are helping on the front lines by modifying their manufacturing processes.

“We are asking customers requiring components related to COVID-19 support and treatment to reach out to us as soon as possible,” Laura Wilson, marketing manager at Fluortek, said in an email. “Our team is making sure components related to COVID-19 support and treatment are prioritized while keeping other customer projects on schedule. Our employees have stepped up to the challenge and are doing what it takes.”

“We are working closely with several world-leading medical device companies to ramp up production of certain devices that may help fight the COVID-19 pandemic,” added Kaitlin Sullivan, marketing manager at Putnam Plastics.

Many car manufacturers in April started to shift manufacturing practices to support ventilator production. General Motors, Ford and Tesla started producing ventilators with partners Ventec, GE Healthcare and Medtronic, respectively.

Ford and GE Healthcare announced on March 31 that Ford would start producing 50,000 ventilators in 100 days at its Michigan plant and would continue to produce 30,000 a month as needed. Medtronic on March 30 reported making 250 ventilators a day with the help of Tesla, and many other companies like Minnetronix, Foxconn, Nortech and Xerox have ramped up production of ventilators, too.

“As manufacturers of respiratory equipment worldwide struggle to meet current demand, we are honored to support them with expedited deliveries of the tubing and sealing components necessary to make their life-saving products work,” Amy Swab, marketing communications manager of Trelleborg Sealing Solutions, told MT+E. “For these healthcare companies and other industrial, oil & gas, and aerospace manufacturers who are doing their part to deliver vital equipment and services during this time of need, we are forever grateful. We are here for them. We will help however we can to provide the sealing products they need.”

Flexan’s Chicago plant makes a part that goes into a miniature pneumatic that a customer provides for about 50% of all ventilators sold in the U.S., according to Mike Huiras, the tubing company’s VP of sales and marketing.

“So they use their miniature pneumatics in all ventilators and other respiratory devices that are in high demand,” Huiras said. “We’re seeing a pretty large increase in those segments. In addition to offering support to our current customers, we have extensively reached out to a number of ventilator manufacturers and every other company that’s announced they are focusing their manufacturing to ventilator parts and components. So where there is a grade for medical grade tubing, seals, connectors, things of that nature, we have actively reached out to over 50 companies and (are) in contact with a number of them.”

Many tubing and extrusion companies have also noted that their employees’ safety is a top priority during the pandemic.

“Fluortek is implementing strategies to protect our workforce from COVID-19 while ensuring continuity of operations,” Wilson said. “The integrity of our manufacturing facilities is our number one priority. Fluortek manufactures products in controlled environments and are certified ISO 13485:2016. We have implemented restrictions on manufacturing plant attendance and visitors.”

“Our number one priority is making sure we operate in a safe and healthy environment for our employees who are deemed essential for manufacturing and ensuring their safety,” added Huiras.

The coronavirus has affected more than 3.7 million people globally, with the U.S. experiencing the most COVID-19 cases at just over 1.2 million so far, according to Johns Hopkins University’s Center for Systems and Science Engineering. Nearly 260,000 people have died around the world since the pandemic started, including more than 70,000 in the U.S.

“Nobody in this space right now is looking to capitalize on the situation, but only to figure out how we can help and focus our efforts there,” Huiras said.