The pulsed field ablation market heated up in 2023 and continues to make waves this year with more companies entering the space. Intravascular lithotripsy is having its moment as well – Shockwave Medical was recently acquired by Johnson & Johnson for $13.1 billion while FastWave Medical kicked off its first-in-human study of its IVL tech. Heart valve implants and ablation catheters are also some notable technologies making waves in the first quarter of 2024.

Here, we’ve highlighted the top five catheter-delivered medtech innovation news stories getting the most attention on Medical Tubing + Extrusion as we approach the midway point of 2024:

5. Stereotaxis submits Magic ablation catheter for U.S., European approval

Stereotaxis submitted its Magic ablation catheter for European and U.S. regulatory approval in March.

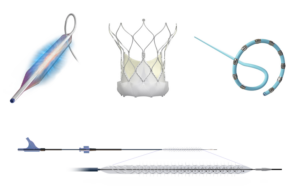

Magic is a robotically navigated magnetic ablation catheter that performs minimally invasive cardiac ablation procedures. It incorporates design features meant to enhance patient safety, procedural effectiveness and efficacy and the physician experience. The regulatory submissions followed successful clinical results in an ongoing trial.

Read more about the system and the future commercial availability >>

4. Biosense Webster wins Japanese approval for Varipulse pulsed field ablation

Biosense Webster’s Varipulse pulsed field ablation won Japanese approval in January to treat AFib.

The company designed Varipulse to treat symptomatic drug-refractory recurrent paroxysmal AFib using pulsed field ablation. It has a Varipulse catheter, a variable-loop multielectrode catheter, the TruPulse generator and the Carto 3 3D cardiac mapping system. Varipulse is pending CE mark in Europe and remains unavailable for sale in the U.S. and the E.U.

Read more about the latest pulsed field ablation on the market >>

3. Abbott is launching its latest Navitor TAVI system in the U.S.

In March, Abbott launched the latest Navitor heart valve technology in the U.S. in March.

Features of the system include stable and precise delivery, excellent hemodynamics, and low paravalvular leak rates. The company built the system upon a proven, durable platform with a future-ready design. The Navitor Vision has highly visible markers that help identify 3mm-4.5mm depth to optimize implant confidence and patient outcomes.

2. Reflow Medical wins CE mark for temporary spur stent

In January, Reflow Medical received CE mark approval for its Bare Temporary Spur Stent System.

The system treats de novo or restenotic lesions in the infrapopliteal arteries, followed by a commercially available drug-coated balloon, to enhance drug absorption. The goal is to provide stent-like results while leaving no metal behind in below-the-knee lesions. The Bare Temporary Spur Stent System reduces clinically driven target lesion revascularization. In addition, it improves wound healing, reduces recoil, and improves vessel patency through one year.

Read about the temporary spur stent and what executives are saying >>

1. FastWave Medical kicks off first-in-human study of its IVL tech

FastWave Medical in January announced the successful completion of enrollment for its first-in-human study of its peripheral intravascular lithotripsy (IVL) system to treat calcified cardiovascular disease.

FastWave’s IVL platform is meant to treat calcific artery disease by fracturing calcium deposits with a balloon catheter that delivers shock waves. The company says its peripheral IVL technology offers a user-friendly design with a deliverable, low-profile, rupture-resistant balloon. The system delivers durable and predictable circumferential ultrasonic pressure to fracture calcium.

Read more about the IVL tech and the study >>

Here’s more: The 10 most-read catheter-based innovation stories of 2023 >>